We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The 2024 Union Budget introduced significant changes to how profits from selling real estate are taxed. Previously, long-term capital gains (LTCG) from property sales were taxed at 20% with an adjustment for inflation, known as indexation.

The new rules offer two options: a 12.5% tax rate without indexation or retaining the 20% rate with indexation. These changes aim to simplify the tax system and provide flexibility to property sellers.

In this article, we will discuss the details of these changes, the impact they make in the view of a property owner and also compare the new tax structure with the old one.

Prior to the 2024 Union Budget, the profits earned from selling a real estate property in India were determined and taxed according to the duration of ownership.

This structure aimed to account for inflation over time, offering relief to long-term property investors.

The Union Budget 2024 introduced various changes affecting capital gains taxation on immovable properties:

The long-term capital gains (LTCG) tax rate on immovable properties has decreased to 12.5%. This lower tax rate reduces the financial burden on individuals and businesses selling property.

Businesses, especially those in real estate, benefit as they can allocate saved resources to other areas like operations or investments.

To understand the implications, companies can hire taxation services to ensure accurate compliance. Taxation services help both individuals and businesses navigate these updates smoothly, ensuring compliance with reduced tax rates and better financial management during property deals.

Initially, the Union Budget 2024 removed the indexation benefit for immovable properties. However, it faced backlash as without this adjustment, the tax liabilities increased. As a result, the changes were rolled back and now individuals have two choices for taxing long-term capital gains on immovable properties bought before July 23, 2024:

This flexibility allows taxpayers to select the option that minimizes their tax liability or can also opt for professional taxation and accounting services to handle these changes smoothly.

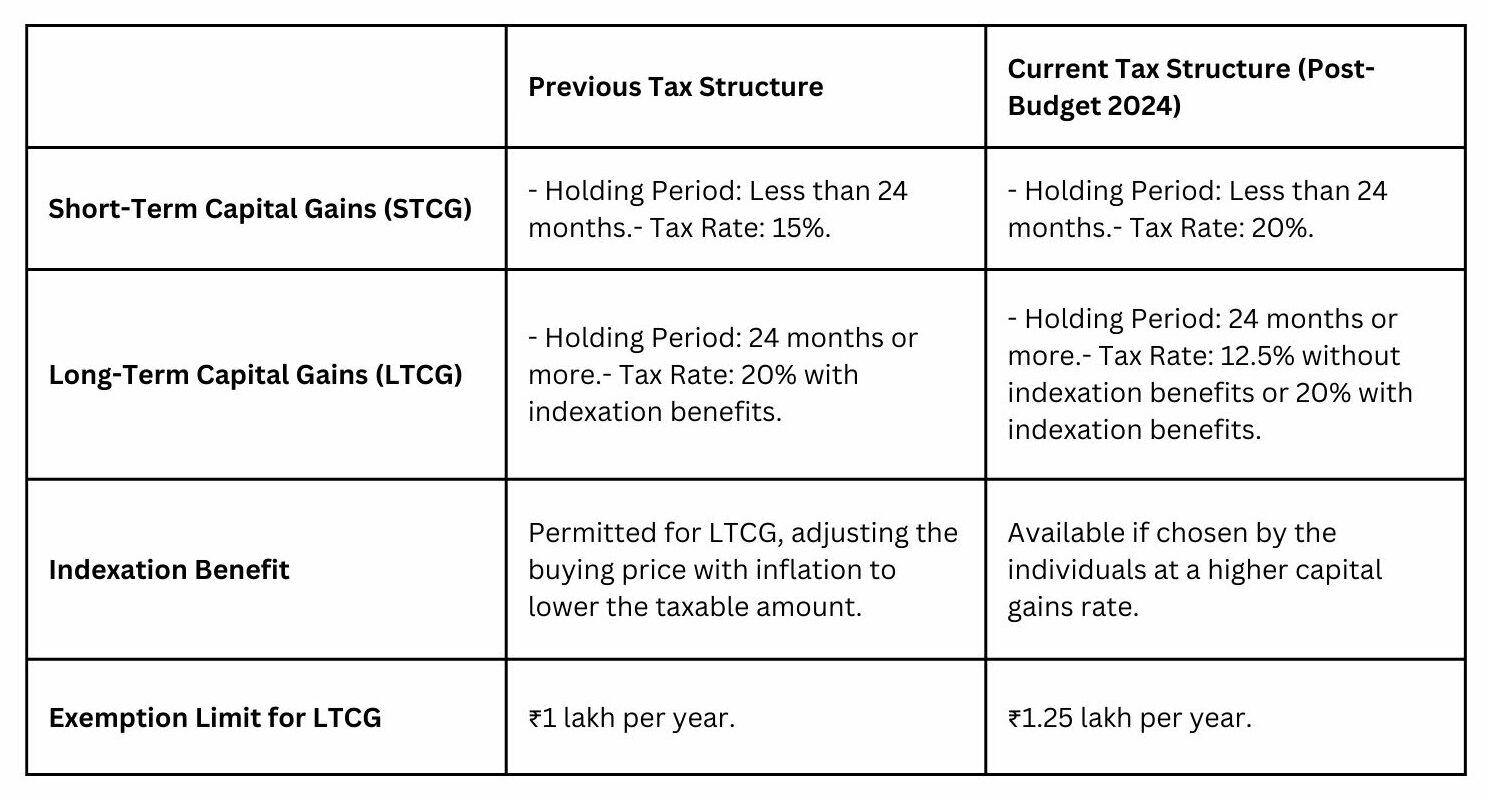

Here’s a simplified comparison between the previous and current capital gains structures:

The 2024 Union Budget introduces significant changes to the taxation of capital gains from immovable properties, impacting property owners and investors in several ways:

The 2024 Union Budget has changed how profits from selling property are taxed. Previously, if you sold a property after holding it for more than two years, you paid a 20% tax on the profit, but you could adjust the property’s original purchase price for inflation, which reduced the taxable amount.

Now, the tax rate has been lowered to 12.5%, but if you choose this rate, you can no longer adjust for inflation. For example, if you bought a property in 2001 for ₹15,00,000 and sold it in 2024 for ₹80,00,000, under the old system, after adjusting for inflation, your taxable profit would be ₹25,55,000, leading to a tax of ₹5,11,000.

Under the new system, without the inflation adjustment, your taxable profit is ₹65,00,000, resulting in a higher tax of ₹8,12,500, despite the lower tax rate.

The removal of indexation may influence investors to reassess their holding periods. For properties expected to appreciate significantly, the lower 12.5% tax rate without indexation could be advantageous.

These changes may encourage and motivate investors to focus on short to medium-term investments, as the benefits of long-term holdings with indexation are now limited to the higher tax rate option. This shift could lead to increased market activity along with investors looking for quicker returns.

Individuals should evaluate their portfolios to determine the optimal time to acquire or dispose of properties, considering the new tax implications.

The 2024 Budget introduced changes to how profits from selling property are taxed in India. Initially, the government reduced the tax rate but removed the adjustment for inflation, which led to concerns among property owners and investors. In response to public feedback, the government allowed sellers to choose between the new tax rate without inflation adjustment or the previous rate with it.

Now, 6 months after the 2024 Budget, India’s real estate market has seen noticeable growth. Residential sales crossed 225,000 units in the first 9 months of this year, with the help of the launch of 215,000 new projects. The prices of the properties also saw moderate yet steady growth of capital value of around 4-7% YoY during the same period.

The mid-segment contributed to around 43% of total residential demand with 27% of demand for the high-end segment in the first 9 months of 2024. Luxury housing’s share of this increasing demand also went from 6% in 2019 to a whopping 16% this year. These developments highlight a dynamic real estate market in India, influenced by policy changes and evolving preferences of buyers.

With the government focusing on urban housing and infrastructure, there has been a boost in construction and property transactions. Institutional investments hit a record $8.9 billion across 78 deals in 2024, surpassing the previous 2007 record by 6%.

The 2024 Union Budget introduced significant changes to capital gains taxation on immovable properties. Short-term capital gains tax is now 20% for properties held less than 24 months, up from 15%. Long-term capital gains tax is reduced to 12.5% for properties held over 24 months, but the inflation adjustment benefit is removed. These changes make taxes simpler and more uniform, affecting how property owners plan their finances and investments.

If you are looking for Financing and Taxation services in India, get in touch with GJM & Co. At GJM & CO., we offer services related to Business Formation, Payroll Management, Bookkeeping and Accounting Services, and more. You can email us at info@gjmco.com or call us.