We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The cash flow statement is one of the most important financial statements for any business. It shows the movement of cash in and out of a company during a specific time period. While profits look good on paper, cash is what keeps the lights on and the business running day to day.

A business can be profitable and still go bankrupt if it runs out of cash. This is why many say “cash is king” in business. In this article, we will see what is cash flow statement and how to analyse it in detail.

The income statement and cash flow statement tell different stories about a company’s performance. The income statement matches sales with related expenses, regardless of when cash actually changes hands. The cash flow statement tracks real capital movements, showing if a company can generate and maintain actual cash.

Several key factors create differences between these financial stories:

Many companies report substantial profits while experiencing negative cash flow due to heavy investments and working capital requirements. Also, some businesses report accounting losses while generating positive cash flow through efficient operations and minimal capital needs.

Here are the particulars that are included in the statement of cash flow.

Operating activities cover the core business functions that generate revenue, the main ongoing source of a company’s cash. This section shows whether the main business operations are bringing in or using up cash.

Key parts include:

The operating section adjusts net income for non-cash expenses and timing differences. For example, when accounts receivable increases, operating cash flow decreases by that amount since sales were recorded as revenue, but cash wasn’t collected.

When accounts payable increases, cash flow improves since expenses were recorded but not yet paid. After adding back depreciation (a non-cash expense) and making other adjustments, operating cash flow often differs significantly from reported profit.

Consistent positive operating cash flow usually signals healthy business fundamentals.

Investing activities show cash flows related to long-term assets. These are the investment decisions that shape future business capabilities. This section reveals management’s priorities for business growth, technology updates, and competitive positioning.

Investing activities include:

Negative investing cash flow often shows company growth through expansion. These investments should generate future cash flows, though the timing and amount remain uncertain.

Positive investing cash flow might indicate asset sales, potentially showing strategic repositioning or financial necessity. The long-term impact depends on how the company uses this cash and what is divested.

Financing activities show transactions with lenders and shareholders; the ways organizations get capital and return value to investors. This section reveals management’s approach to financial structure, showing decisions about debt, equity distribution, and keeping or returning cash.

Key financing activities include:

The financing section reveals corporate strategies. Young companies often show positive financing cash flow as they raise capital to fund growth. Mature companies frequently show negative financing cash flow through dividends and share repurchases.

The financing section also reveals shareholder return strategies. Companies focused on dividends show regular negative financing cash flows. Growth-focused companies might show positive financing cash flow from taking on debt to fund expansion while keeping operating cash for the business.

Financial statements present operating cash flows using either the direct or indirect method, each showing cash movements differently.

The direct method simply reports cash received and paid, categorizing each transaction:

This approach resembles a checkbook register, making it intuitive even for non-financial readers. Viewers can immediately see where the cash came from and where it went.

Despite being easier to understand, only about 10% of public companies use this method because it’s more complex to prepare and requires additional disclosures. Companies must maintain separate records of cash transactions rather than simply adjusting accounting figures.

The indirect method, used by about 90% of companies, starts with net income and adjusts it to show operating cash flow:

This approach highlights the specific reconciling items between profit and cash flow. While less intuitive for non-financial readers, it provides valuable diagnostic information. Analysts can quickly spot concerning trends, like growing inventory or expanding receivables, that might indicate operational problems despite reported profits.

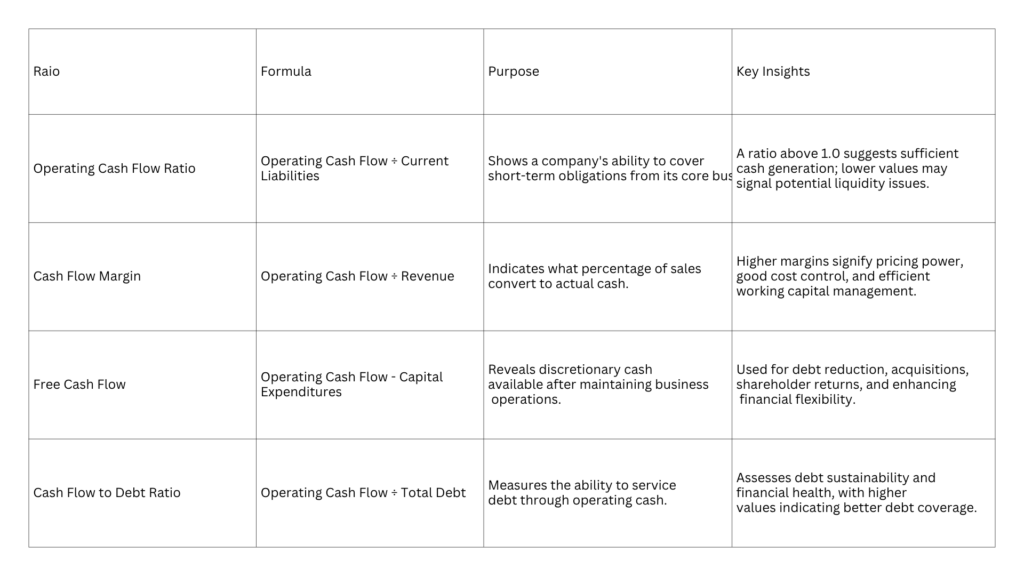

Several important ratios help assess financial health and performance trends:

Here are two ways for companies to manage cash flow efficiently.

Effective cash management requires forward-looking projections including expected receipts, payments, capital expenditures, and financing activities. These forecasts allow proactive responses to potential shortfalls or opportunities to use surplus cash.

Good cash flow forecasting typically includes:

Companies develop different forecasting approaches based on size and complexity.

Small businesses might use simple spreadsheets projecting 12-16 weeks forward with weekly granularity.

Large enterprises typically employ sophisticated treasury management systems with daily projections for the near term and monthly projections extending several years.

Many companies also develop multiple forecast scenarios, creating backup plans for tough conditions while identifying opportunities during good periods. For each scenario, they develop specific action plans, which expenses to cut first if sales decline or which expansion opportunities to pursue if excess cash accumulates.

Working capital management effectiveness varies significantly by industry:

As a result, it is crucial to manage cash flow via:

The statement of cash flows provides insights that balance sheets and income statements alone can’t deliver. Understanding cash flow patterns reveals a company’s sustainability, growth potential, and financial resilience, critical considerations for investors, lenders, and management. Rather than looking at cash flow in isolation, thorough analysis combines cash flow insights with comprehensive financial evaluation, competitive assessment, and strategic positioning.

If you are looking for accounting cash flow-related services, visit GJM & Co. We offer services to businesses across various industries, including bookkeeping and accounting services, Financing, Taxation, Business Formation, payroll management, and more. You can email us at info@gjmco.com or schedule a call.