We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

“In this world, nothing is certain except death and taxes,” Benjamin Franklin famously remarked. Yet, what if there existed an investment avenue that not only helped mitigate your tax burden but also potentially grew your wealth substantially? Equity Linked Saving Schemes (ELSS) present precisely this dual opportunity.

However, what makes these tax-saving mutual funds so distinctive in India’s financial space? And why should they warrant serious consideration in your investment portfolio? Let’s explore the topic in this article.

Equity Linked Saving Schemes are tax-advantaged mutual fund offerings that predominantly allocate capital to equity securities. These instruments have a statutory lock-in period of 36 months from the date of investment, notably the shortest restrictive timeframe among all available tax-saving alternatives under Section 80C of the Income Tax Act.

The fundamental structure of ELSS funds involves a diversified portfolio typically comprising 80-100% equity instruments across various market capitalisations, with the remaining allocation directed toward debt and money market instruments for liquidity management.

ELSS investments qualify for tax deductions up to ₹1,50,000 under Section 80C of the Income Tax Act, 1961. This provision offers substantial tax relief potential even to equity mutual fund investors.

For example, an individual in the 30% tax bracket can realise tax savings of approximately ₹46,800 annually (including applicable cess) by maximising their ELSS investment. This represents significant capital retention that would otherwise be remitted to tax authorities.

Additionally, it is important to note that long-term capital gains from equity investments up to ₹1,25,000 per financial year remain exempt from taxation. Gains exceeding this threshold are subject to a 12.50% tax rate in the form of Long Term Capital Gains (LTCG) without indexation benefits.

Also, you can invest in ELSS through two primary approaches:

This method involves investing the entire intended amount at a single point in time. This approach may be suitable for investors with substantial liquid funds available for immediate allocation and those with a defined view on market valuations.

However, there is a probability that this strategy may expose the investor to potential timing risk, as the entry point significantly influences overall investment performance. If the investment is made during pick time, and a correction follows, the portfolio may sink.

However, in the long run, investments are always in the green. Thus, for long-term investment, this timing risk gets eliminated.

A Systematic Investment Plan facilitates periodic investments of predetermined amounts at regular intervals (typically monthly). This offers several advantages:

That said, you should consider your overall portfolio and risk appetite before investing.

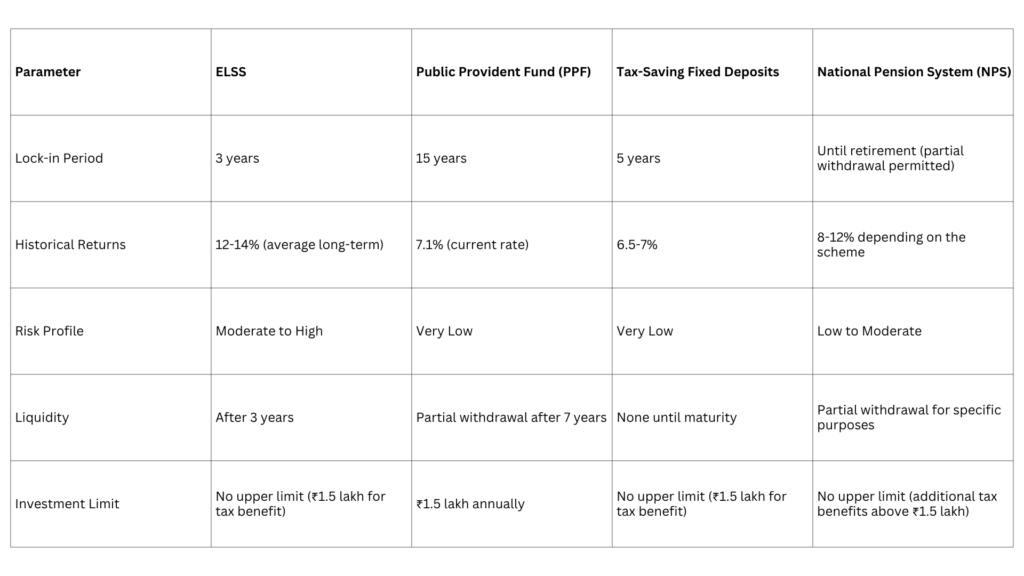

When evaluating ELSS against other Section 80C investment options, here is what you need to consider

You should note that historical performance may not necessarily predict future returns. ELSS funds, being market-linked instruments, are inherently exposed to market volatility.

The ELSS category includes numerous funds, which can make fund selection challenging. Here is what you should consider:

When evaluating ELSS funds, examine performance not merely during bullish periods but across full market cycles. Look for funds that have demonstrated consistent performance over 3-year, 5-year, and, if available, 10-year periods. The most revealing analysis often comes from examining how funds performed during market corrections.

The fund’s allocation across market capitalisations significantly influences both risk exposure and return potential:

Beyond capitalization distribution, analyze sector allocations to manufacturing, financial services, and technology, etc. Assess whether the fund’s sector weightings align with your perspective on economic growth drivers.

The fund manager’s experience and investment approach are directly related to your future returns.

Look for consistency in the investment philosophy. Funds that frequently change their approach or investment style typically underperform those with disciplined adherence to a well-defined strategy.

Cost considerations impact long-term returns. Currently, expense ratios for ELSS funds typically range between 1.5% and 2.5%. Even a differential of 0.5% compounds significantly over long investment horizons.

Always prefer direct plans over regular plans to minimise expense ratios. The typical differential of 0.7-1.0% annually between direct and regular plans can also translate to improved returns for you.

The asset management company’s overall reputation, governance standards, and risk management capabilities provide crucial context:

You should also incorporate quantitative measures into your analysis. This includes:

Rather than viewing these metrics in isolation, compare them against category averages and benchmark indices to contextualise performance attributes.

While ELSS funds have a mandatory 3-year lock-in period, optimal results typically require longer investment horizons:

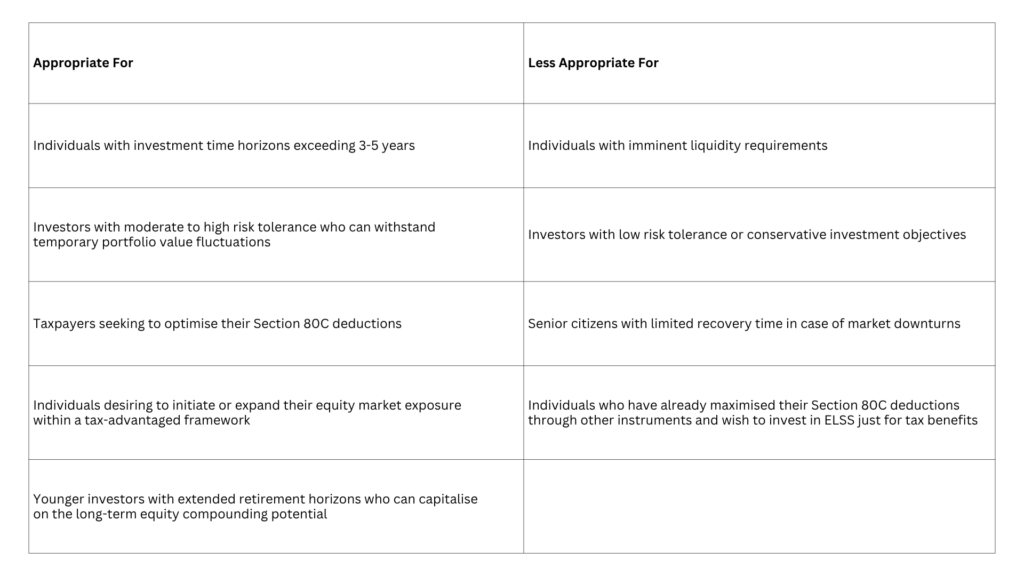

While ELSS offers many benefits, it may not be suitable for all investor profiles.

Here are a few factors to consider before investing in ELSS funds.

While SIPs mitigate timing concerns of investing, if you are making a lump-sum investment, you should consider market valuations. Periods of market corrections can be more favourable entry opportunities as you get ELSS fund units at a lower price and also get more units. However, know that precisely timing the market is not possible.

Include ELSS investments into your annual tax planning calendar rather than viewing them as year-end obligations. Spreading investments throughout the year via monthly contributions helps avoid the March rush while potentially capturing favorable entry points across market cycles.

When your ELSS completes its 3-year lock-in period, resist the temptation to automatically redeem. Instead, evaluate the fund against your current financial goals and market outlook. If the fund continues to perform well and aligns with your investment strategy, stay invested for the long term. Tax benefits are merely the initial advantage; the true value lies in continued capital appreciation.

Equity Linked Saving Schemes offer you tax optimisation with wealth creation potential. Their relatively lower lock-in period, compared to alternative tax-saving options, and consistent long-term performance make them popular among investors. However, consider your overall goal and risk tolerance level to make an investment decision.

While you can minimise your tax liabilities with ELSS, you need to plan wisely to manage your overall taxes. To get help with taxation, get in touch with GJM & Co. We offer services related to Taxation, Financing, Payroll Management, Bookkeeping and Accounting Services, Business Formation, and more. Email us at info@gjmco.com or call us to know more.