We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The technological revolution driven by Information Technology (IT) and Information technology-enabled services (ITeS) has transformed the global economy. These advancements allow even smaller businesses to compete with industry giants, bridging geographical gaps through efficient communication and streamlined operations. In this article, we will cover everything you need to know about Gujarat IT/ITeS to help you leverage this scheme for your business.

Gujarat, the leading industrial state in India, offers a fertile ground for IT/ITeS businesses, backed by solid infrastructure and a strong focus on the Ease of Doing Business (EoDB).

On the lines of it, the Gujarat IT/ITeS Policy (2022-27) is designed to attract investments, create jobs, and position the state at the forefront of the IT/ITeS industry. Here are a few pointers that would help you with the details.

The main goals of the Gujarat IT/ITeS Policy 2022-27 are to:

An eligible IT/ITeS unit is defined as any IT/ITeS business with a minimum of 10 employees, setting up operations in Gujarat during the policy’s operative period, or an existing unit in Gujarat undergoing expansion with a minimum of 15 employees post-expansion.

The policy is effective from the Government Resolution (G.R.) date and will remain in force until March 31, 2027.

Entities that apply for assistance before this date and commence operations before March 31, 2028, are eligible for the incentives provided under this policy.

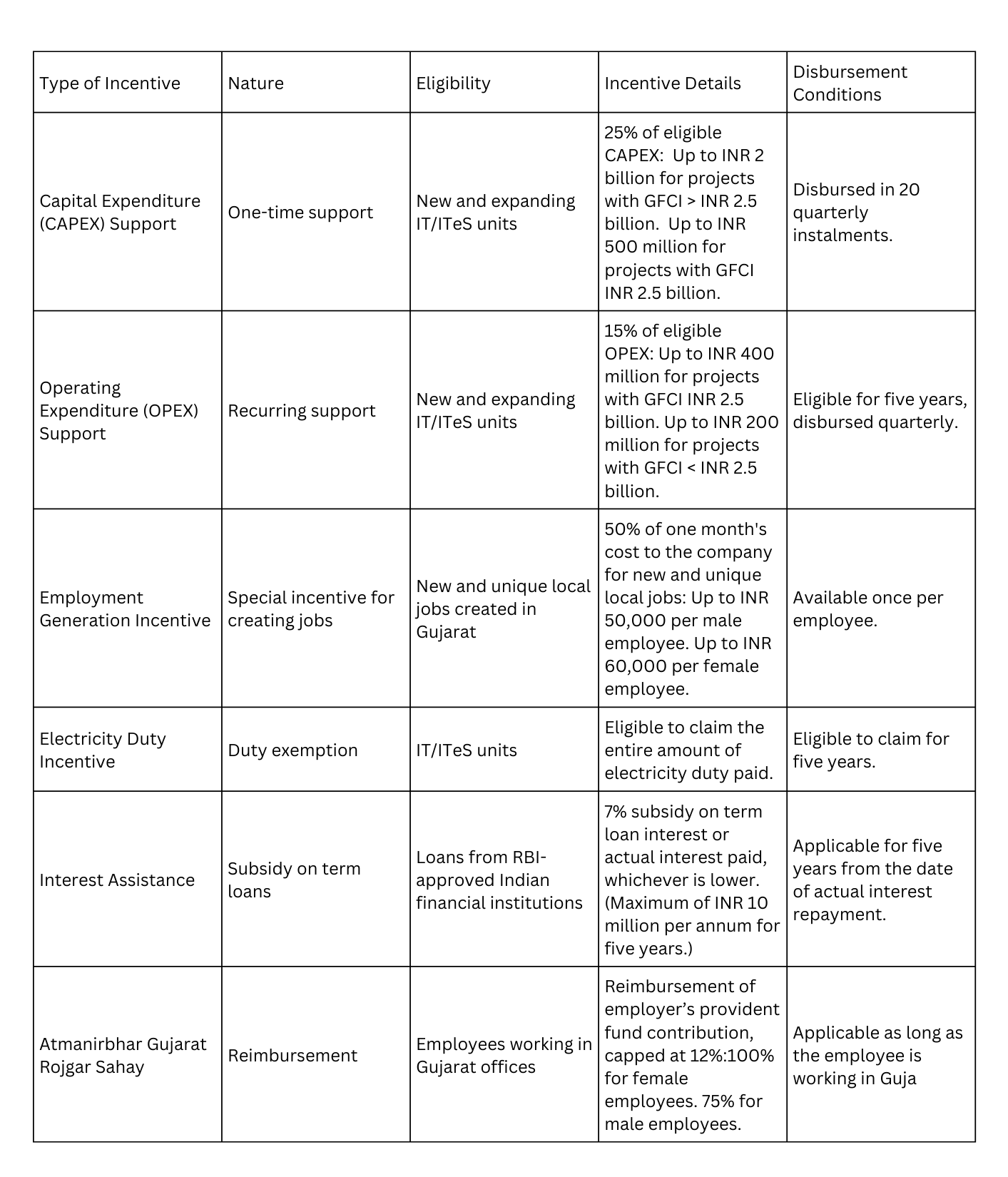

The Gujarat IT/ITeS Policy 2022-27 offers various incentives to eligible businesses to promote growth and development in the IT/ITeS sector. Here’s a detailed table summarising the key incentives:

The new Incentive Management Portal developed by the Directorate of ICT & e-Governance is a game-changer for businesses in Gujarat’s IT/ITeS sector. This portal handles incentive applications, claims processing, disbursement, dispute resolution, empanelment of co-working IT office spaces, and applications for IT skill development courses.

All existing IT/ITeS units in Gujarat must register on this portal to avail of the policy benefits.

Note: All eligible new units must submit their incentive application within one year from the start of commercial operations. Similarly, all eligible expansion units must submit their incentive application within one year from the month they achieve the eligible employee count.

To ensure that businesses can maximise their benefits under the Gujarat IT/ITeS Policy 2022-27, it is crucial to adhere to the specified timelines for submitting claims as given:

With incentives aimed at reducing operational costs, supporting infrastructure development, and promoting talent upskilling, Gujarat is poised to become a preferred destination for IT/ITeS businesses.

This policy fosters an innovative ecosystem and strengthens Gujarat’s position as a global financial and IT hub, making it an attractive destination for domestic as well as international investors.

To manage bookkeeping and accounting services in India, get in touch with GJM & Co. Additionally, we also help you with payroll management, Business Formation, Financing, Taxation, etc. Schedule a call with us or send us an email at info@gjmco.com.