We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

Thanks to technology, businesses do not have to limit themselves to geographical boundaries anymore. They can supply products and services to countries that are thousands of miles away and grow beyond geographical boundaries. However, businesses that wish to go global should know international trade rules, terminology, and trade practices. One such aspect of international trade is ‘Incoterms’.

Businesses should get familiar with Incoterms before entering the global market. In this article, we will cover what is Incoterms, its applicability, and its importance for international businesses in detail.

The International Chamber of Commerce, widely known as ICC, has specified ‘Incoterms’ or ‘international commerce terms’. The origin of Incoterms can be traced back to 1936.

ICC published these rules for the first time that year and has updated them periodically as the business environment changed over time.

Incoterms are internationally recognized standards for businesses. They help interpret the common terms mentioned in international trade contracts.

Using Incoterms can help businesses avoid a lot of confusion and misunderstanding regarding the responsibilities of the parties in an international contract.

The most recent version of Incoterms is Incoterms 2020. Incoterms 2020 consists of 11 rules that describe the responsibilities of sellers and buyers regarding insurance, shipment, documentation, and other activities related to logistics.

7 of these rules apply to all modes of transport while 4 apply to transports through sea and inland waterways only.

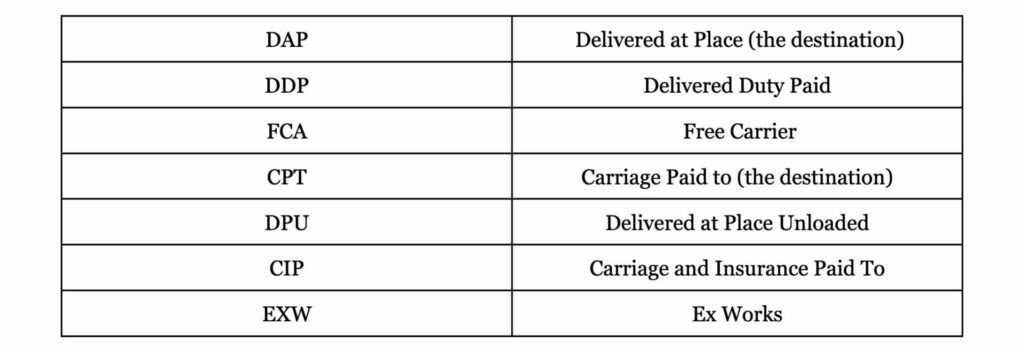

Here are the 7 rules that apply to all modes of transport.

Each term represents certain rules regarding the shipment. For example, as per the term CIP, the seller takes up all the risks related to the goods until they are delivered to the first carrier at the place of shipment. However, the seller has to bear the carriage cost and insurance cost incurred until the goods reach their destination.

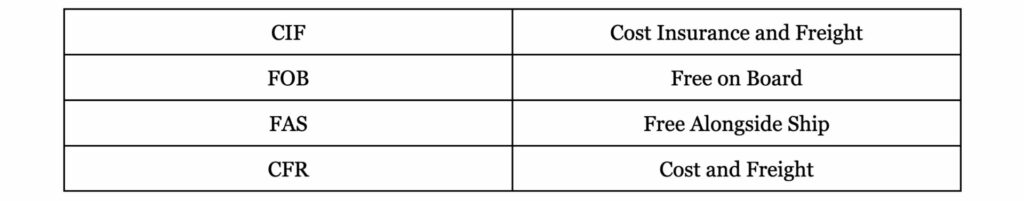

The following 4 rules apply to transport of goods by sea and inland waterways.

These cover aspects that are related to shipments through the sea and waterways only. For example, the term CIF denotes that the seller is responsible for delivering the goods on the vessel at the shipment port after export clearance.

The seller must pay for transport until the port of destination and for the insurance cover throughout the journey until the goods reach their destination.

Incoterms help businesses understand their trade contracts and responsibilities better.

Understanding Incoterms is crucial for global businesses, their legal advisors, and their CPA firms for the following reasons.

Here are some specific aspects that are not included in Incoterms. Businesses must keep this in mind while drafting international trade contracts.

Incoterms were introduced to bring uniformity to international trade transactions. The ICC updates these terms whenever required to accommodate the changes in the business environment.

If you are planning to take your business to the international market, email us at info@gjmco.com or schedule a call. We also offer a wide range of services to help your business including accounting and bookkeeping services, payroll accounting, payroll management, Business Formation, Taxation, Virtual CFO, and more. Get in touch with us today.