We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The Union Budget is one of the most anticipated events each year as it directly affects the lives of common people. While every year, the budget is announced on 1st February, this year, because of the elections, Budget 2024 was announced later on 23rd July 2024, by Finance Minister Nirmala Sitharaman. She emphasized that this year’s Finance Bill is centred on employment, skill development, MSMEs, and the middle class.

On 16th August 2024, the Finance Bill (No 2) 2024 was approved in Parliament and has been enacted into law, which marks an end to the entire budget exercise of Modi 3.0’s first full-fledged budget for 2024-25.

In this article, we will discuss various points given under union budgets and their implications for common men.

Here are the key highlights of the 2024 Budget:

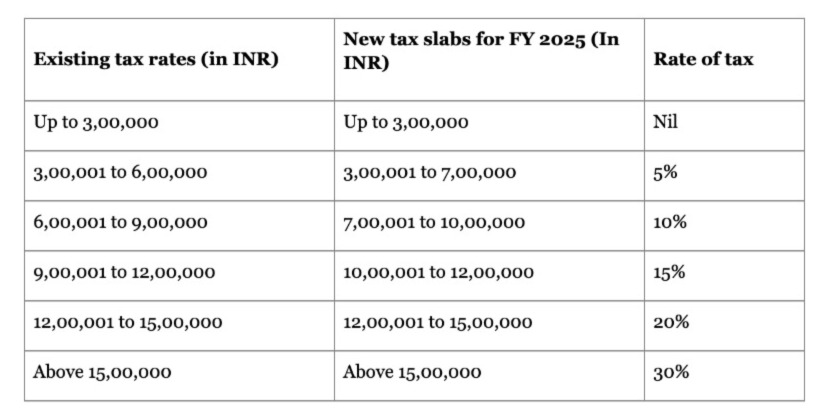

The 2024 Budget of India introduced significant tax reforms aimed at providing relief to taxpayers and simplifying the tax structure. The new income tax regime features revised tax slabs, with no tax for income up to ₹3 lakh, and progressive rates ranging from 5% to 30% for higher income brackets.

With the government’s ongoing focus on the new tax regime, the following changes to the tax slab rates have been proposed:

Additionally, the standard deduction has been increased to ₹75,000 under the new regime. The capital gains tax has also been streamlined, with short-term gains taxed at 20% and long-term gains at 12.5% for specific assets. Moreover, the Securities Transaction Tax (STT) on option sales has been increased from 0.0625% to 0.1%, impacting traders and investors.

For Viksit Bharat, the 2024 Budget of India has allocated a record ₹11.11 lakh crore for infrastructure development (3.4% of GDP). This includes significant investments in railway corridors, metro expansions, Vande Bharat trains, and new airports. The government aims to modernize India’s infrastructure, which will not only improve connectivity but also create numerous job opportunities and stimulate economic growth.

Additionally, the budget promotes viability gap funding to encourage higher private participation and optimize working capital requirements. The focus on developing industrial parks, corridors, and urban infrastructure is expected to boost the manufacturing sector and increase the overall competitiveness of the Indian economy.

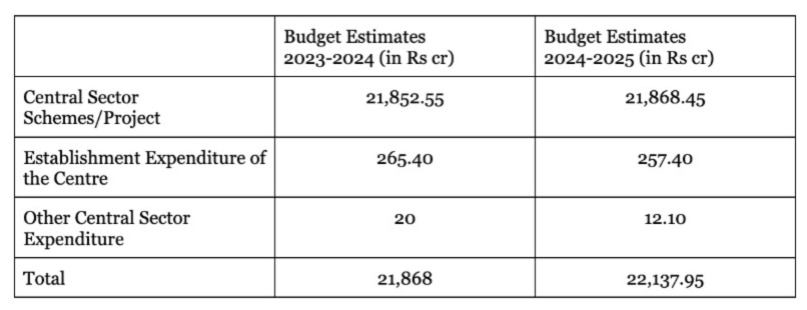

The total estimate of spending in MSMEs for 2024-2025 is Rs 22,137.95 crores. Let’s take a look at the comparison of this year’s MSMEs budget with last year’s.

In the 2024 budget, Finance Minister Nirmala Sitharaman announced several key changes for MSME schemes. The Emergency Credit Line Guarantee Scheme (ECLGS) saw an increase in allocation from ₹5.25 lakh crore to ₹6 lakh crore. The Mudra loan limit under the “Tarun” category was also doubled from ₹10 lakh to ₹20 lakh for entrepreneurs who have successfully repaid previous loans. Additionally, the Khadi Gramodyog Vikas Yojana received a 13% increase in funding, now allocated ₹1,037.19 crore.

On the other hand, some schemes experienced budget cuts. The Scheme for Fund for Regeneration of Traditional Industries (SFURTI) saw a 7.14% reduction in its allocation, now set at ₹260 crore. The Scheme for Promotion of Innovation, Rural Industry and Entrepreneurship (ASPIRE) also faced a decrease, with its outlay reduced to ₹20 crore from ₹22.23 crore.

The Union Budget 2024 has placed a strong emphasis on advancing India’s technological landscape and digital economy. Finance Minister Nirmala Sitharaman announced a corpus of ₹1 lakh crore with a 50-year interest-free loan for long-term financing or re-financing with low to nil interest rates to support the growth of India’s tech-savvy youth and encourage private sector innovation in sunrise domains.

The budget also focuses on expanding the electric vehicle ecosystem, supporting manufacturing and charging infrastructure, and promoting higher adoption of e-buses for public transport.

Additionally, the government aims to boost local manufacturing investment through the Indian Semiconductor Mission (ISM) and has introduced a new scheme to strengthen deep tech for the defense sector.

The 2024 Union Budget of India has several implications for the common man, impacting household budgets, savings and investments, and the job market. Here’s a breakdown:

The 2024 Union Budget of India aims to positively impact household budgets by increasing the standard deduction for salaried employees from ₹50,000 to ₹75,000, providing more disposable income and easing some financial pressure on households. These changes will let taxpayers save Rs 17,500 with the new tax rules.

Additionally, the reduction in customs duties on gold, silver, and other precious metals could lower the prices of these items, making them more affordable for consumers. These changes, along with lower tax rates and increased exemptions, are designed to boost consumer spending on various goods, ultimately enhancing the overall financial well-being of households.

The Budget has introduced significant changes to savings and investments, notably increasing the tax on long-term capital gains from 10% to 12.5% and on short-term capital gains from 15% to 20%. These changes may prompt investors to reconsider their strategies, particularly those with substantial investments in financial markets.

As an Individual, to manage these changes effectively and optimize personal finances, it is advisable to seek the services of a tax accountant.

The budget has introduced several measures to boost job opportunities and employment. Here’s a simple breakdown:

The budget also recognizes that artificial intelligence (AI) could change the job market and provides plans to manage these changes while using AI’s advantages.

The 2024 Budget brings several changes that could impact an individual’s finances. Understanding these updates is important for making informed decisions and planning for the future, especially with regard to taxation effectively.

For Financing and Taxation services in India, contact GJM & Co. We offer assistance and guide you through different prospects of business including Business Formation, payroll management, bookkeeping and accounting services, and more. Call us or email us at info@gjmco.com.