We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

Under normal circumstances, the HDFC Defence Fund, which was established in June 2023, is mandated to invest 80% to 100% of its assets in equity and equity-related instruments of companies in the defence and allied sectors.

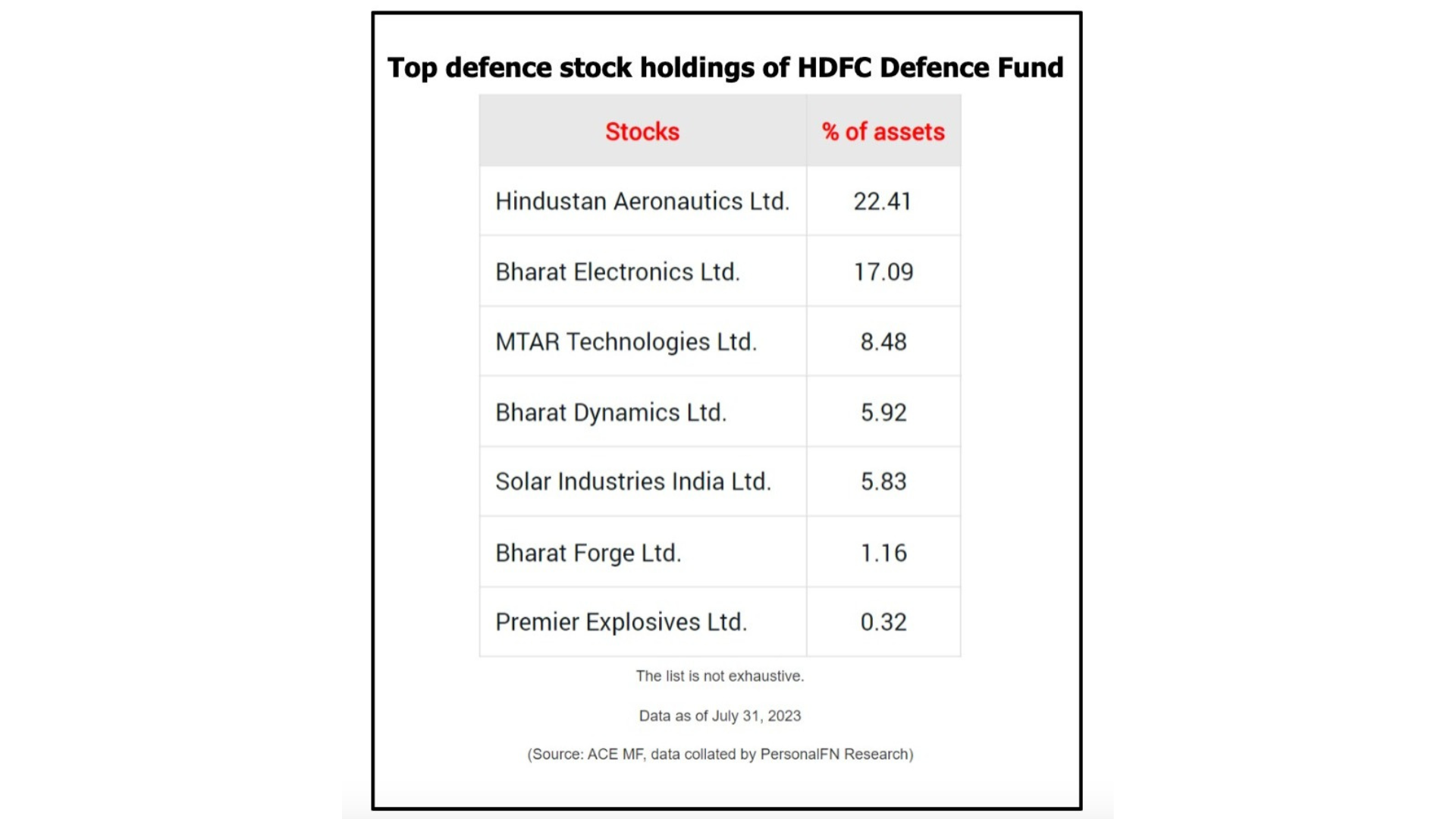

The fund currently owns 18 stocks in a concentrated portfolio, with largecaps making up the majority (50.23%) and midcaps and smallcaps the remaining 49.77%.

As of July 31, 2023, the top five defence stocks include Hindustan Aeronautics, Bharat Electronics, MTAR Technologies, Bharat Dynamics, and Solar Industries India.

The companies that are also involved in the defence industry are those in the engineering and capital goods sectors, including L&T, BEML, Bharat Forge, and others.

After seeing a positive response to its NFO and realising that its investment universe is small (totaling 21 stocks), HDFC Defence Fund has placed restrictions on new investments. This is done to protect the interests of current investors as well as the overall investment strategy.