We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

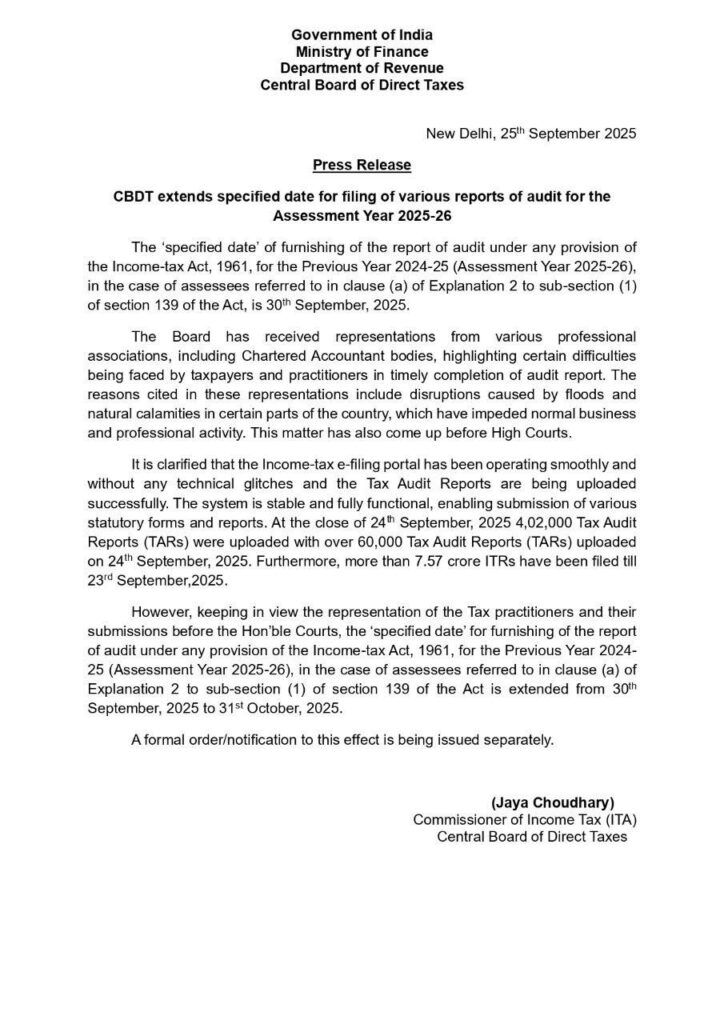

In a significant relief to taxpayers and professionals, the Central Board of Direct Taxes (CBDT) has extended the due date for furnishing audit reports under the Income-tax Act, 1961, for the Assessment Year 2025-26. The deadline, which was earlier set for 30th September 2025, has now been pushed to 31st October 2025.

The announcement, issued through a press release by the Ministry of Finance on 25th September 2025, comes in response to widespread requests from tax practitioners, Chartered Accountant bodies, and other professional associations. These groups highlighted the mounting challenges faced in completing audit reports within the original timeline, primarily due to disruptions caused by natural calamities and other unforeseen circumstances.

Every year, the deadline for filing audit reports is a crucial period for taxpayers, especially businesses and professionals falling under the audit requirements of the Income-tax Act. This year, several professional associations brought to the attention of the CBDT the unusual difficulties faced by taxpayers.

Many parts of the country recently witnessed floods and natural calamities, which disrupted normal business and professional activities. Chartered Accountants and practitioners, who play a critical role in supporting taxpayers, raised concerns about their ability to complete and file audit reports on time. These challenges even found their way into submissions before High Courts, underlining the seriousness of the situation.

Considering these difficulties, the government recognized the need to provide additional time for the timely completion of statutory compliance. The extension is expected to offer much-needed relief to businesses and professionals, enabling them to meet requirements without undue stress.

Interestingly, while extensions are often sought due to technical difficulties with the income-tax e-filing system, the CBDT clarified that this year the portal has been functioning smoothly.

According to official data, as of 24th September 2025, over 4,02,000 Tax Audit Reports (TARs) had been uploaded successfully. On that same day alone, more than 60,000 TARs were filed. Additionally, more than 7.57 crore Income Tax Returns (ITRs) had already been submitted till 23rd September 2025.

The stability of the system ensures that taxpayers and practitioners can file their reports without glitches. The extension, therefore, is less about technology and more about accommodating real-world challenges faced by people in affected regions.

The immediate impact of the extension is clear: taxpayers and professionals get an additional month to finalize and submit their audit reports. For many, this extra time will be a welcome reprieve, especially those in regions affected by floods and natural calamities.

It also underscores the government’s responsive approach. By considering representations from professional bodies and acknowledging the difficulties raised before courts, the CBDT has demonstrated flexibility. Such decisions foster a sense of trust and cooperation between taxpayers, professionals, and authorities.

For businesses, this extension provides breathing space to carefully review their financials, ensure accuracy in reporting, and avoid errors that may lead to complications later. For tax professionals, the additional month reduces the pressure of handling multiple audits simultaneously.

Tax compliance is often seen as a daunting annual ritual, but it is also a critical part of ensuring a transparent and accountable economic system. Audit reports play an essential role in maintaining financial discipline and ensuring that businesses operate within the framework of law.

By extending the deadline, the CBDT is not just offering relief, it is acknowledging the realities of doing business in India, where factors beyond one’s control, such as natural calamities, can significantly affect compliance timelines.

At the same time, the large number of ITRs and audit reports already filed indicates a growing awareness and commitment among taxpayers toward fulfilling their obligations on time. This balance—between strict compliance and necessary flexibility—reflects the evolving maturity of India’s tax ecosystem.

While the extension provides welcome relief, it should not be seen as an excuse for complacency. Businesses and professionals are encouraged to use this time wisely to ensure that all necessary documentation is accurate, complete, and filed without last-minute rush.

For those who often struggle with tax compliance, seeking professional help is a smart choice. Firms offering taxation services can assist in streamlining the process, ensuring that audit reports and returns are filed correctly and on time. Leveraging professional expertise not only reduces the stress of compliance but also minimizes the risk of penalties or scrutiny later.

The CBDT’s decision to extend the deadline for filing audit reports for Assessment Year 2025-26 from 30th September to 31st October 2025 is a pragmatic step that balances regulatory needs with the realities faced by taxpayers and professionals. With the income-tax portal functioning smoothly and millions of filings already completed, the extension is primarily a gesture of empathy toward those impacted by circumstances beyond their control.

As taxpayers and professionals gear up to utilize this additional month, the focus should remain on accuracy, transparency, and timely compliance. After all, a well-functioning taxation system is the backbone of a strong economy, and collaborative efforts between citizens and authorities are what keep it robust.