We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The Central Board of Direct Taxes (CBDT) has announced an extension in the due dates for furnishing the Tax Audit Report and Income Tax Return (ITR) for the Assessment Year (AY) 2025–26 under the provisions of the Income-tax Act, 1961.

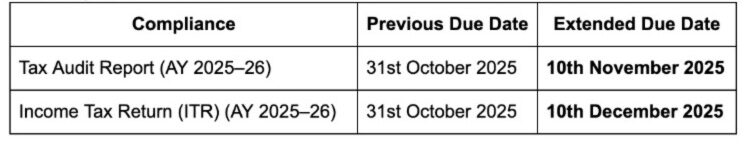

As per the latest press release issued by CBDT:

Originally, the due date for submission of the Tax Audit Report was 30th September 2025, which was later extended to 31st October 2025. With this recent announcement, the deadline now stands at 10th November 2025.

Similarly, the due date for filing the ITR, which was earlier 31st October 2025, is now 10th December 2025.

This decision has been taken by the CBDT to provide taxpayers and professionals with additional time to comply with statutory requirements and ensure smoother filing processes.

A formal order or notification regarding the same will be issued separately by the Department.

Summary of Extensions: