We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

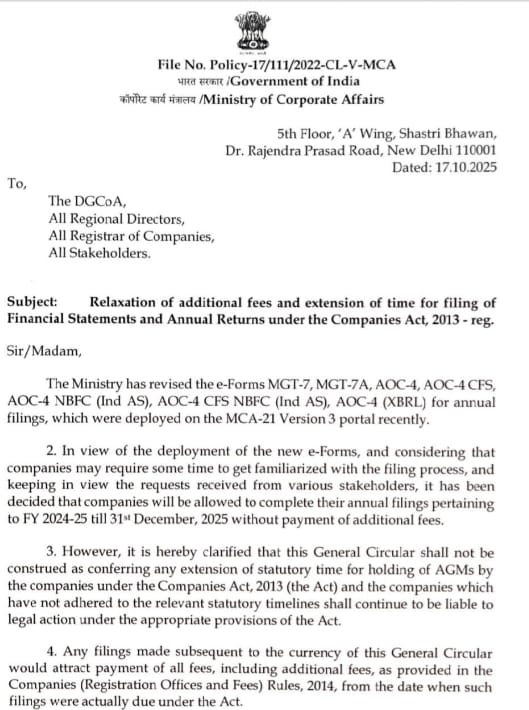

In a much-awaited relief for companies across India, the Ministry of Corporate Affairs (MCA) has announced an extension for filing annual returns and financial statements under the Companies Act, 2013. As per the circular dated 17th October 2025, companies can now file their AOC-4 and MGT-7/MGT-7A forms for the financial year 2024–25 without paying any additional or late fees until 31st December 2025.

This move comes as part of the MCA’s efforts to ease the compliance burden on companies following the deployment of new e-Forms on the MCA-21 Version 3.0 portal. The ministry acknowledged that corporates might require additional time to get accustomed to the upgraded filing process and system interface.

What Does the Circular Say?

The official circular (File No. Policy-17/111/2022-CL-V-MCA) states that the MCA has revised and recently deployed multiple e-forms related to annual filings — including:

Considering the new forms and system updates, the MCA recognized that companies may face technical or procedural difficulties while adjusting to the new version. Hence, as a one-time relaxation, the ministry has waived off additional fees for filings made till 31st December 2025 for FY 2024–25.

Key Highlights of the MCA Circular 06/2025

Why This Update Matters

The MCA’s decision is a welcome step for the corporate community, especially given the growing reliance on digital filings. The recent upgrades in the MCA-21 Version 3.0 portal are aimed at improving compliance efficiency and accuracy through automation and better data management.

However, with new systems often come technical challenges, from login and validation issues to delays in uploading and verification. The government’s understanding of these transitional difficulties and its move to provide additional time reflects a proactive and supportive regulatory approach.

For companies, chartered accountants, company secretaries, and finance professionals, this extension serves as a breathing space to align internal processes, review filings thoroughly, and avoid last-minute technical snags.

Conclusion

The MCA Circular No. 06/2025 is a timely move to ease compliance difficulties during the transition to upgraded e-filing systems. Companies can now complete their AOC-4 and MGT-7/MGT-7A filings for FY 2024–25 without paying any additional fees up to 31st December 2025.

That said, the relaxation does not extend AGM deadlines or cover other forms like LLP Form 8, ADT-1, MGT-14, DIR-12, MSME-1, and PAS-6. Hence, businesses should continue to comply with other statutory requirements as per the existing timelines.

This circular underscores the MCA’s commitment to balancing regulatory compliance with practical convenience, ensuring that the shift to the new MCA-21 V3 portal is smooth for all stakeholders.