We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The Input Tax Credit (ITC) mechanism, which is a part of the Goods and Services Tax (GST) has redefined the indirect tax system in India. ITC allows businesses to offset taxes paid on inputs, input services, and capital goods (assets that a business uses for its operations or production) against their output tax liabilities. It helps them reduce their overall tax burden.

However, the process of claiming ITC on capital goods, particularly the possibility of obtaining refunds for unutilized ITC, creates a lot of issues for businesses. This article covers the details of ITC on capital goods, exploring eligibility criteria, legal provisions, refund policies, and more.

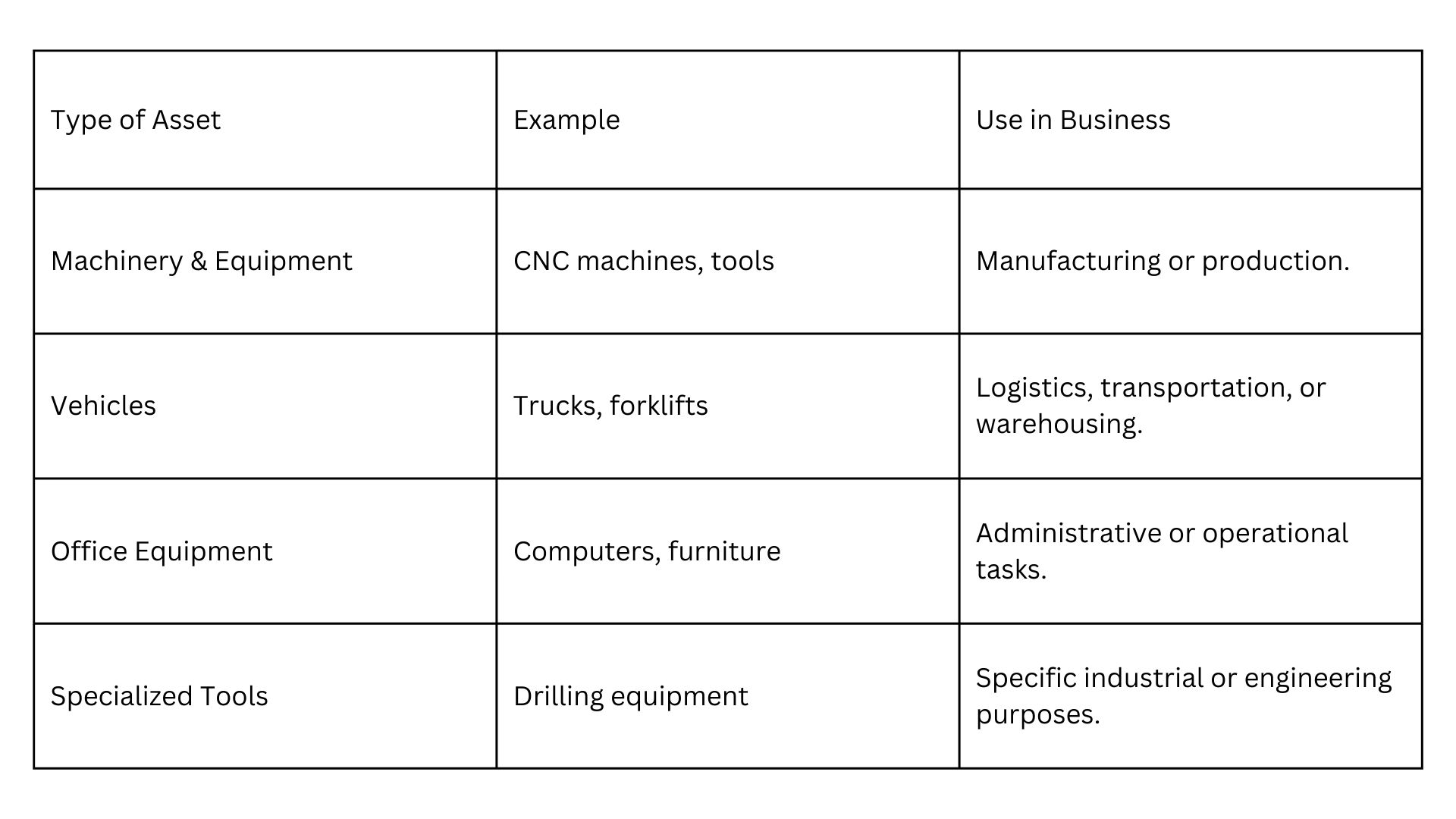

Under GST, capital goods are defined as goods that are used or intended to be used in business activities, that are capitalized in the books of accounts of an enterprise. Capital goods are meant for long-term use.

Unlike inputs or input services, capital goods have a longer economic life and are not consumed immediately in the production process. Some examples of capital goods include equipment, machinery, plant, or vehicles, used for business purposes.

For businesses to claim ITC on capital goods, certain conditions must be met:

Additionally, businesses should ensure that they’re claiming ITC as per the due date. Proper documentation, like accurate bookkeeping and tax invoices, is needed to avail ITC. You can take the help of professional taxation services to understand the eligibility of your business.

The eligibility and utilization of ITC on capital goods are governed primarily by Sections 16 and 17 of the CGST Act among many others:

Section 16 of the IGST Act provides special provisions for zero-rated supplies, such as exports and supplies to Special Economic Zones (SEZs).

Businesses making zero-rated supplies can claim ITC even if their output tax liability is zero. However, refunds for ITC on capital goods are typically excluded under current rules, causing liquidity challenges for exporters and SEZ suppliers.

Refund of unutilized ITC is generally permitted for inputs and input services. However, ITC accumulated on account of capital goods is typically excluded from refund eligibility, as per the provisions of Rule 89(4). This is because rule 89(4) of the CGST Rules excludes capital goods from the definition of “Net ITC.”

As a result, businesses cannot claim refunds for ITC accumulated due to the purchase of capital goods, even when such goods are used exclusively for zero-rated supplies.

The GST framework is transformative but it has certain limitations that impact the business community, particularly regarding ITC on capital goods. The current provisions restricting refunds for unutilized ITC on capital goods create financial challenges, especially for exporters and industries with significant capital expenditure. The solution is here to strategically plan the cash flows to survive and maintain business efficiency.

For this, you can get in touch with us. At GJM & Co, we help you with everything related to Financing, Taxation, Business Formation, Payroll Management, Bookkeeping and Accounting Services, and more. Call us or email us at info@gjmco.com.