We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

India’s financial regulatory framework represents one of the most intricate systems globally, with over 60 regulatory agencies operating simultaneously. The Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and Insurance Regulatory and Development Authority of India (IRDAI) form the main regulatory architecture in India, each leading specialised compliance requirements across different sectors. While the compliance formation falls under the hands of these regulatory bodies, its adherence applies to companies falling under their purview.

In recent years, regulatory management has become advanced with the launch of RegulatoryTech, also known as RegTech. It makes the overall compliance management efficient and easy for regulators and companies alike. In this article, we will cover what RegTech is, how it started in India, current trends, and how it is different from FinancialTech (FinTech).

Let’s have a look at how RegTech’s journey panned out in India.

India’s regulatory technology journey began modestly in the late 1980s with the Committee on Computerisation in Banks (Rangarajan Committee) that laid the foundation for banking sector automation. This era saw the initial digitisation of basic banking operations:

The RBI played a pivotal role during this period, establishing the framework for electronic funds transfer and initiating the move away from paper-based systems. However, these early efforts focused primarily on operational efficiency rather than regulatory compliance technology.

The liberalisation of India’s economy resulted in developments in financial technology:

During this period, regulatory technology remained primarily reactive, with solutions designed to address specific compliance requirements rather than comprehensively transform regulatory processes.

The global financial crisis of 2008 fundamentally altered the regulatory landscape, introducing stringent compliance requirements. In India, this coincided with rapid technological advancement:

This period marked the true emergence of RegTech as a distinct segment within financial technology.

The post-pandemic years have dramatically accelerated digital transformation across India’s financial landscape, which includes:

This is also evident from the market growth projection stats. The Indian RegTech market was valued at approximately $257.34 million in 2023 and is projected to reach an impressive $1.03 billion by 2029 at a CAGR of 23.90%.

Here are the key factors that have contributed to the adoption of RegTech in India.

The regulatory landscape in India has seen increasing scrutiny in recent years, with financial institutions facing more stringent oversight from regulatory bodies such as the RBI, SEBI, and IRDAI. This heightened vigilance has compelled organisations to seek more sophisticated compliance solutions to avoid penalties and reputational damage.

Key regulatory developments driving RegTech adoption include more stringent anti-money laundering requirements, enhanced data protection regulations, including the Digital Personal Data Protection Act, stricter customer due diligence processes, increasingly complex statutory reporting mandates, higher penalties for non-compliance, and a shift toward real-time supervision requirements by regulators.

The Indian government has actively fostered the digital infrastructure required for RegTech evolution through several landmark initiatives:

Digital India Program: Launched in 2015, this program has developed a comprehensive digital infrastructure necessary for advanced regulatory technology solutions. This includes universal digital identity through Aadhaar, digital payment infrastructure through the Unified Payments Interface, cloud computing resources for government and financial institutions, and national broadband connectivity enabling RegTech deployment in rural areas.

India Stack: This set of open APIs and digital public goods has revolutionised how identification, payment, and data management occur within regulatory frameworks:

Regulatory Sandboxes: Both the RBI and SEBI have established regulatory sandboxes that allow controlled testing of innovative RegTech solutions before full-scale deployment, reducing implementation risks while encouraging innovation.

India’s technology sector has also contributed to RegTech adoption by providing a fertile ground for development:

Despite promising developments in the RegTech space in India, significant hurdles remain:

Financial institutions face substantial technical challenges. Core banking systems often operate on outdated technology platforms, while integration between modern RegTech solutions and legacy infrastructure creates compatibility issues. Moreover, data migration from paper-based to digital systems presents accuracy and completeness concerns.

During transition phases, the maintenance of hybrid systems increases operational complexity. Additionally, technical debt accumulated over decades creates resistance to comprehensive digital transformation.

The digital nature of RegTech introduces new risk vectors. Heightened cybersecurity threats to compliance data remain a primary concern alongside customer privacy issues related to automated data processing. Additionally, regulatory uncertainties regarding data storage and processing create compliance challenges.

Cross-border data transfer complications further complicate international operations. Finally, potential systemic vulnerabilities across interconnected compliance systems pose broader financial stability risks.

Institutional adaptation struggles persist throughout the industry. A shortage of skilled professionals with both regulatory and technological expertise limits implementation capabilities. Resistance to technological change among compliance professionals slows adoption rates.

Additionally, the need for extensive retraining and upskilling of existing staff strains resources. Cultural shifts required from rule-based to risk-based compliance approaches demand significant organisational change management. Meanwhile, management faces new challenges in overseeing increasingly automated compliance processes.

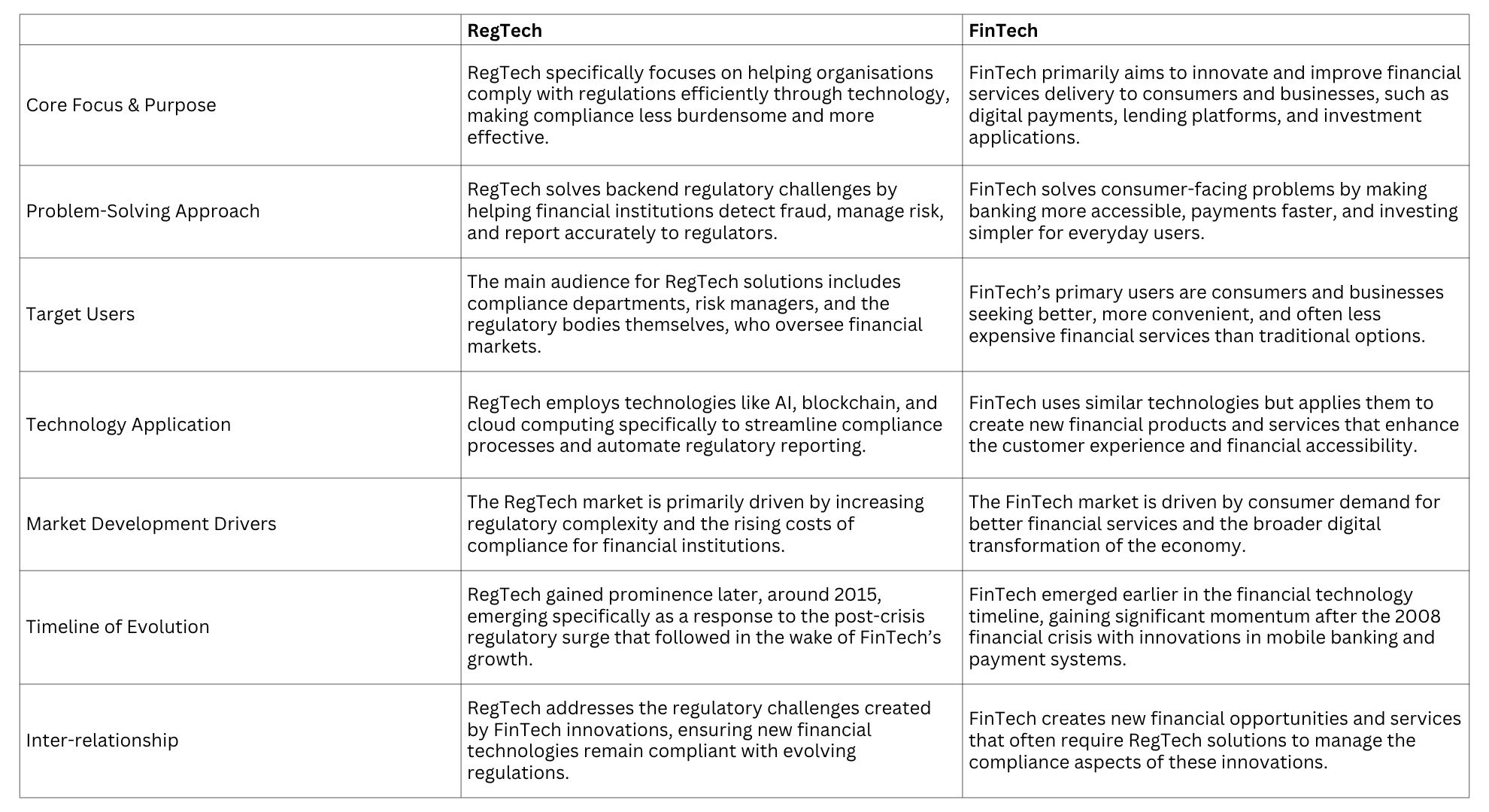

Now that we have covered in-depth about RegTech, let us see how it differs from FinTech.

FinTech and RegTech are two sides of the same coin. FinTech drives financial innovation, while RegTech ensures this innovation complies with regulatory requirements. FinTech develops new financial services, and RegTech provides the compliance tools to support them.

While they have evolved at different times and serve different audiences, they are interconnected. FinTech creates the need for RegTech, and RegTech enables FinTech to operate within regulatory frameworks. We can say that RegTech is part of the broader concept of FinTech.

India is positioning itself strategically within the global RegTech ecosystem through several documented initiatives from key regulatory bodies:

The Reserve Bank of India (RBI) has taken significant steps to develop a comprehensive regulatory framework for RegTech adoption. It has implemented a structured regulatory sandbox framework, with five cohorts announced to date, focusing on retail payments, cross-border payments, MSME lending, the prevention of financial fraud, and a “theme-neutral” cohort, which was announced in October 2023 and concluded in May this year.

This sandbox process has already yielded 18 successful innovations, including digital cash flow-based credit underwriting for MSMEs and voice-based UPI payment solutions supporting local languages.

The RBI hosts monthly virtual meetings with fintech companies through “Finteract” and “Finquiry” sessions, providing platforms for direct interaction with regulators and obtaining verbal non-binding guidance on regulatory matters.

Recognising the need for balanced regulation in the dynamic fintech sector, the RBI has introduced a Self-Regulatory Organisation framework for the Fintech sector (SRO-FT). Under this initiative, the RBI has granted recognition to the Fintech Association for Consumer Empowerment to develop industry standards and serve as an intermediary between fintech participants and regulators.

Multiple regulatory bodies are building a robust innovation ecosystem. For instance, the Account Aggregator framework established by the RBI exemplifies RegTech-DPI integration, facilitating consent-based data sharing between financial entities while enabling users to control their personal financial data flows. This framework demonstrates how automated compliance tools can manage consent processes while meeting stringent privacy mandates.

Beyond banking, the Insurance Regulatory and Development Authority of India (IRDAI) and the Securities and Exchange Board of India (SEBI) have proposed similar regulatory sandbox frameworks specifically designed for insurtech innovations and market-linked financial products, respectively.

India has advocated for the Digital Public Infrastructure’s potential in fostering global digital growth during its G20 Presidency, highlighting user empowerment and regulatory compliance as integral to digital governance.

The United Nations has published “A Global Digital Compact” which aligns closely with India’s DPI model, emphasising the importance of inclusivity, accessibility, and data protection – principles that form the foundation of India’s RegTech approach.

India’s RegTech model increasingly incorporates international best practices while adapting them to its unique market conditions, positioning the country as a potential leader in balancing innovation with regulatory compliance in emerging markets.

As India advances toward its $5 trillion economic vision, RegTech stands as a critical enabler of this transformation. The journey from manual compliance to technology-driven regulatory frameworks represents not merely a technological shift but a fundamental reimagining of financial governance. For businesses across the financial sector, RegTech adoption is likely to transition from optional to imperative. Those who embrace these technologies will gain significant advantages in efficiency, risk management, and market agility.

For Financing and Taxation services in India, consider GJM & Co. GJM & CO. offers a wide range of services including Business Formation, Payroll Management, Bookkeeping and Accounting Services, and more. Email us at info@gjmco.com or call us.