We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

The Union Budget 2025 was announced by Nirmala Sitharaman, the Finance Minister of India, on February 1, 2025. It outlines a comprehensive strategy that aims to stimulate economic growth, implement significant tax reforms, and advance sectoral development across various industries.

The government has set a fiscal deficit target of 4.4% of GDP for the fiscal year 2025-26, down from a revised 4.8% in FY25. (Source: The Hindu) The economy is expected to grow by 6.3% to 6.8% in the next fiscal year, recovering from a 6.4% growth rate this year. Inflation also remains above the Reserve Bank of India’s 4% target (Source: The Hindustan Times).

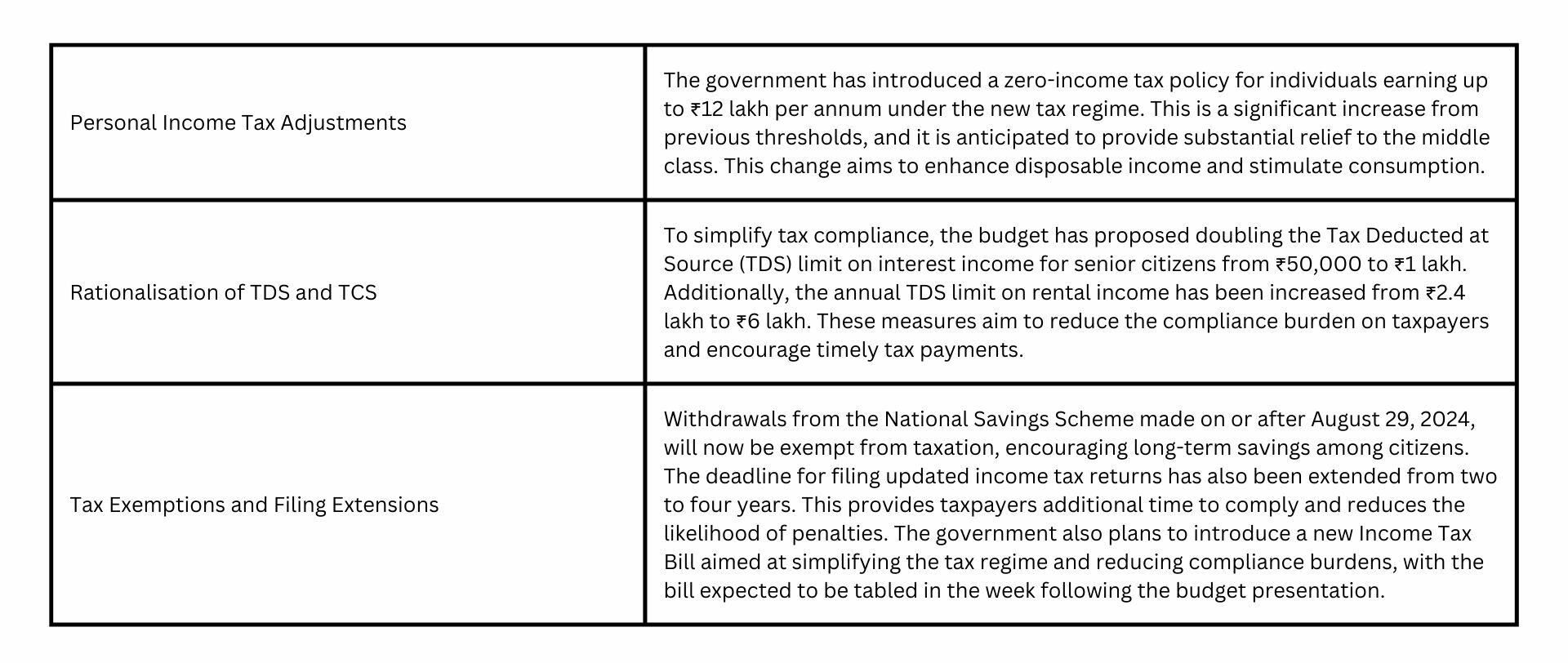

The Finance Minister has also introduced a new Income Tax Bill that aims to simplify the tax regime and reduce compliance burdens. The bill is expected to be tabled in the week following the budget presentation.

This budget reflects the government’s commitment to fostering a more prosperous and self-reliant India. In this article, let’s discuss the key highlights of the Union Budget 2025. Let’s start!

An important aspect of the 2025 budget is the extensive changes made to the taxation system to alleviate the financial burden on individuals and simplify compliance procedures.

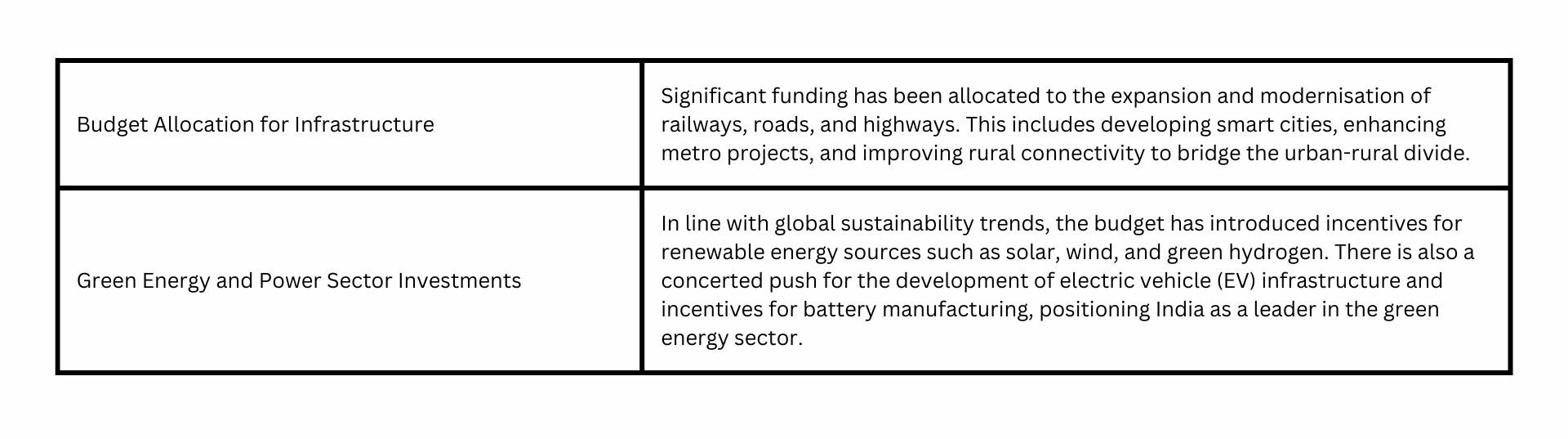

The budget has placed a strong emphasis on infrastructure development, recognising its critical role in economic growth and job creation.

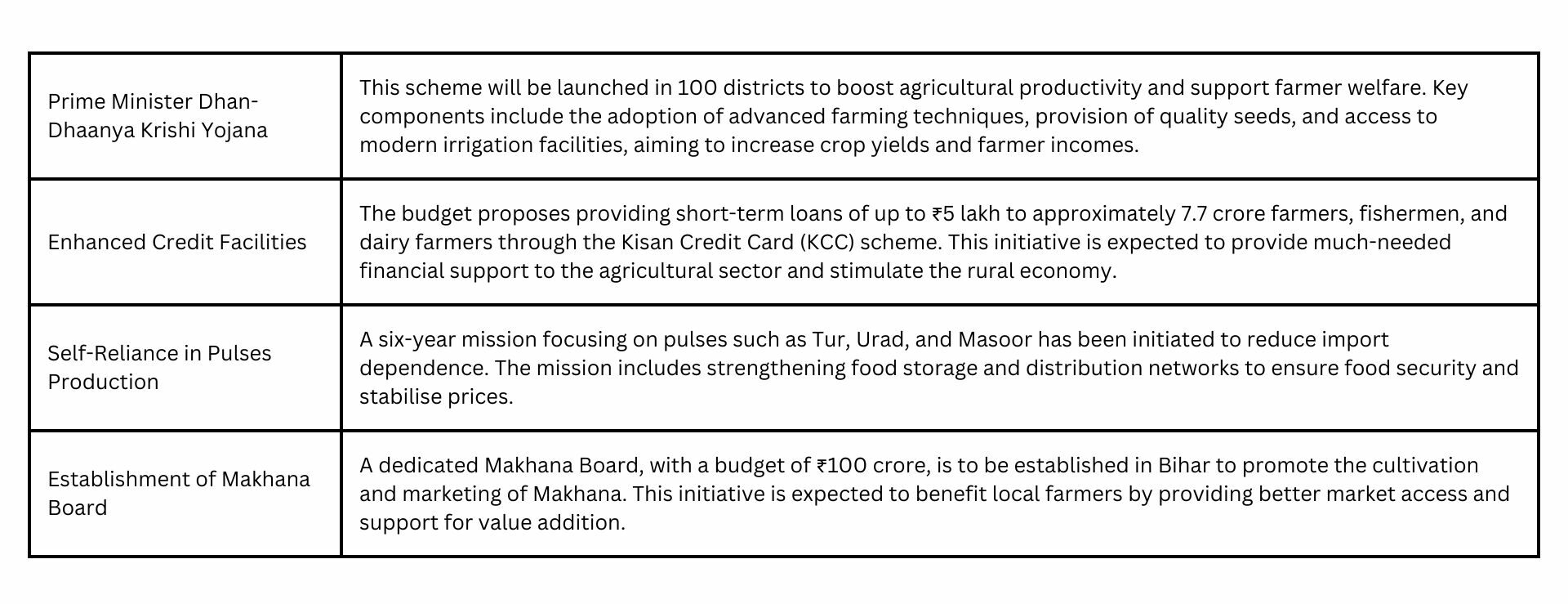

Agriculture has been a focal point in the 2025 budget, with several initiatives aimed at enhancing productivity and ensuring farmer welfare.

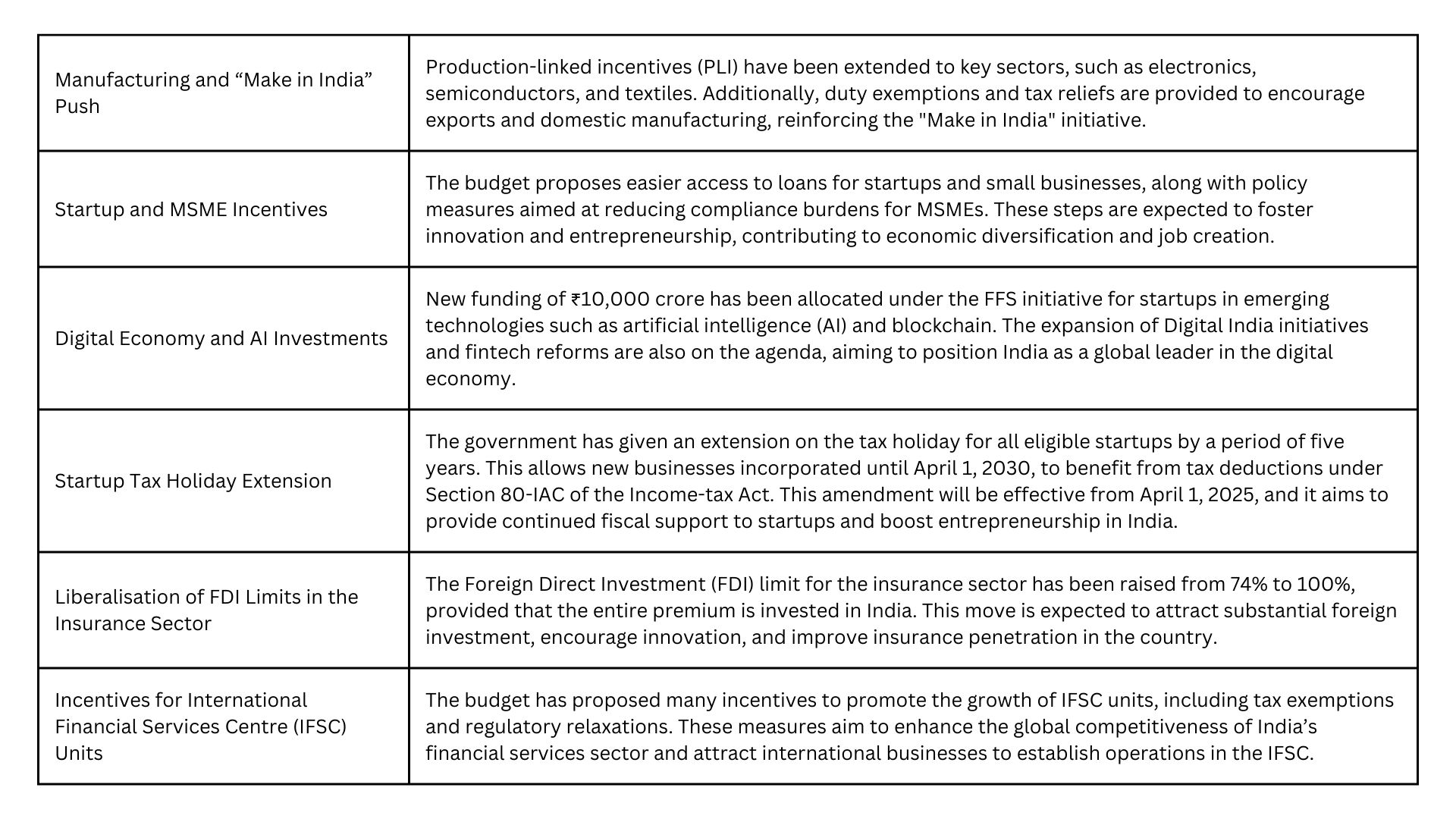

The budget outlines several measures to boost the manufacturing sector, support startups, and facilitate the growth of Micro, Small, and Medium Enterprises (MSMEs).

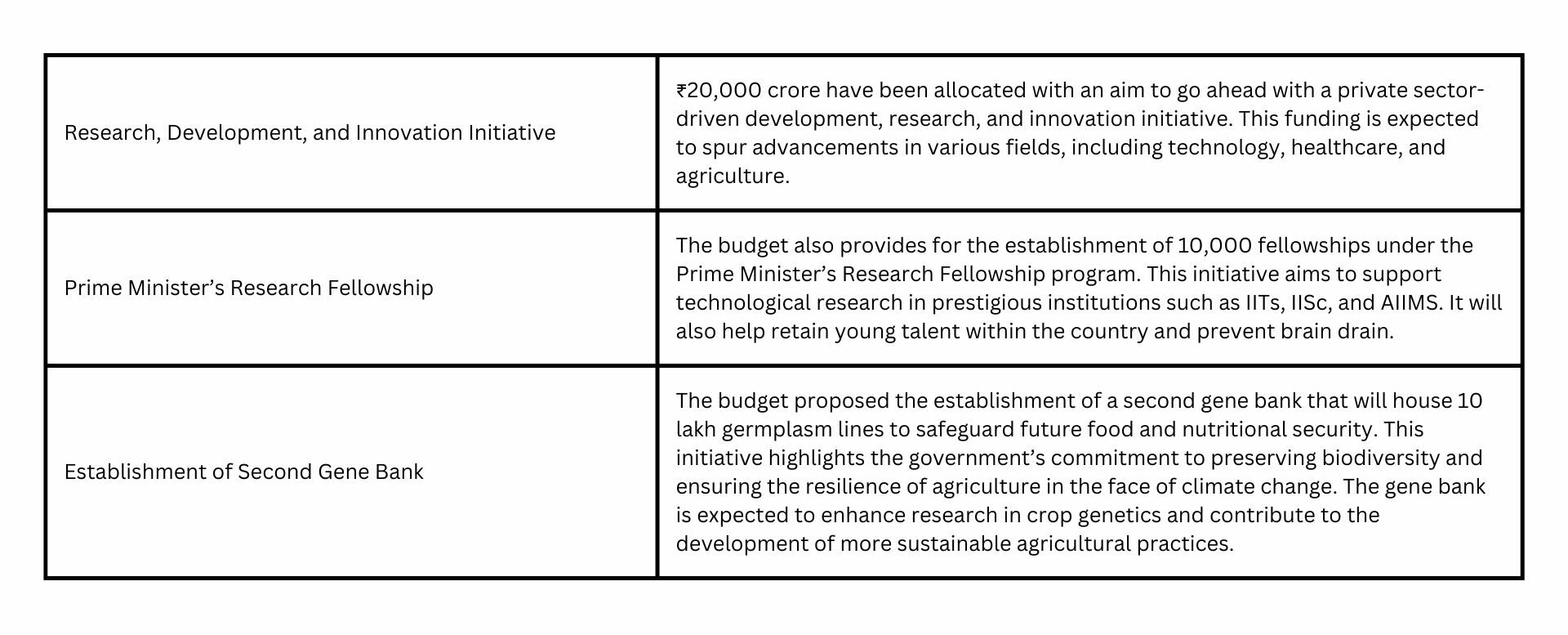

Recognising the importance of research and development, the budget has allocated substantial resources to boost innovation.

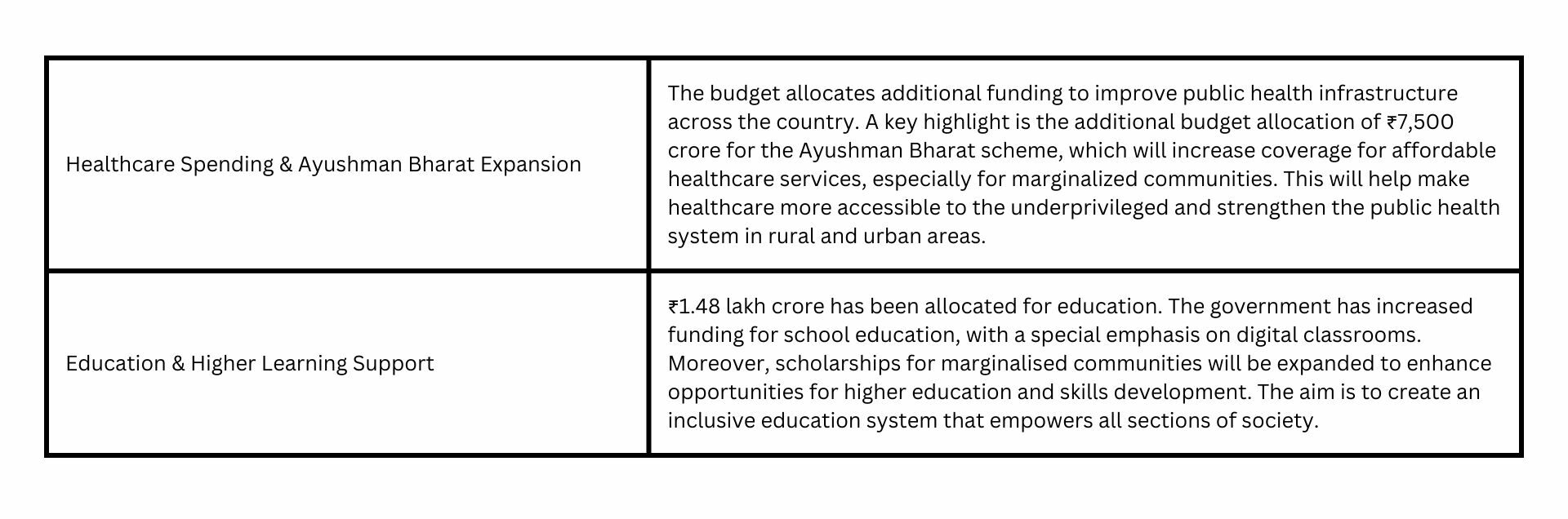

In this section, let’s understand how the Union Budget 2025 has addressed critical areas such as healthcare, education, and social welfare, with a focus on ensuring equitable growth across all segments of society.

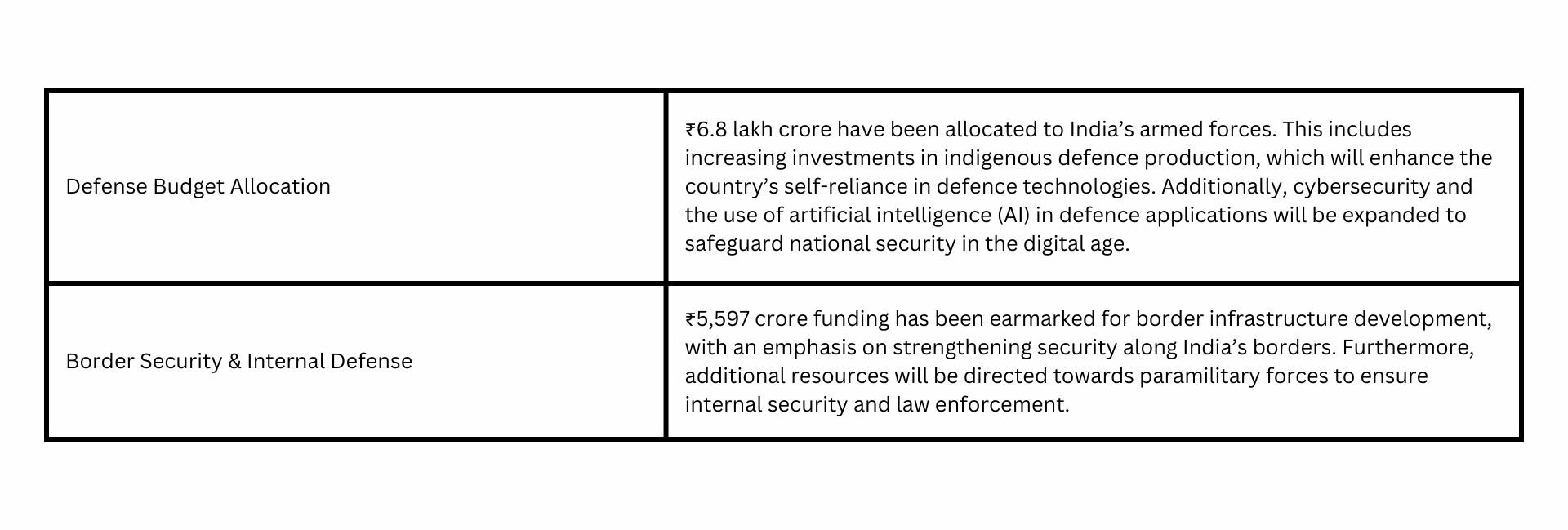

The budget continues to prioritise national security and defence, with a clear focus on modernisation and technological advancements.

The Union Budget 2025 marks a transformative step for India, as it aims to balance short-term economic recovery with long-term growth and sustainability. From significant tax reforms to infrastructure development and investment in the green economy, the budget outlines a balanced approach to addressing the country’s economic challenges.

Overall, with a focus on technology, sustainability, and welfare, the Union Budget 2025 sets the stage for sustained economic growth, job creation, and a more sustainable and equitable future for India.

To know more about how this budget affects your business and revenues and what strategies to adopt, get in touch with GJM & Co. We help you with everything related to Financing, Taxation, Business Formation, Payroll Management, Bookkeeping and Accounting Services, and more. Call us or email us at info@gjmco.com.