We get your business up and moving. We are a passionate bunch of number crunchers /budget heads. Whether it be an entire overhaul of your accounting department, managing your payrolling, or simply serving you as a bookkeeper – we are here.

Hindu Undivided Family (HUF) is a concept in India, primarily used for managing family properties and wealth. It allows a family to be treated as a “single unit/separate entity” for tax purposes, offering potential tax advantages.

The family is managed by the Karta, who makes decisions, while coparceners (members) share ownership. An understanding of how HUF functions and tax on HUF is important for effective wealth management. This article will discuss what HUF is, its main features and the taxation of HUF in India.

HUF stands for Hindu Undivided Family, which is a family unit formed for tax-saving purposes by pooling assets together. It is a joint family structure where the HUF is treated as a separate entity from its individual members.

HUF includes Hindus, Buddhists, Jains, and Sikhs. It gets its own Permanent Account Number (PAN) and files tax returns independently. The head of the HUF is called the ‘Karta,‘ who manages its business affairs.

Now that you know what a HUF is and how it can help save on taxes, let’s take a look at some of its important features:

These features make the HUF a distinctive and beneficial structure for managing family wealth in India.

In India, a Hindu Undivided Family (HUF) is recognized as a separate taxable entity under the Income Tax Act, 1961. The taxation of a HUF mirrors that of individual taxpayers, with the family unit being assessed separately from its members.

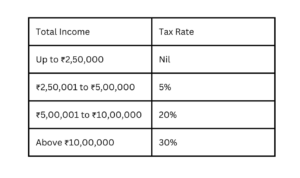

HUFs can choose between the old tax regime and the new tax regime, depending on which is more beneficial for their financial situation. Under the old tax regime for the financial year 2024-25, the tax rates are as follows:

In addition to the above, a surcharge is levied if the total income exceeds certain limits. A 4% health and education cess is also applicable on the amount of tax computed, including surcharge.

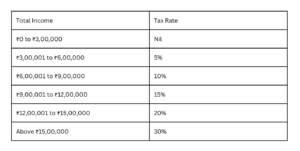

Under the new tax regime, the tax rates are as follows:

From the next financial year, the new tax rate will be applicable which imposes zero tax for income up to ₹12 lakh. You can check more about that in this article.

The new tax regime offers lower tax rates but removes most deductions and exemptions. The choice between the two regimes depends on the HUF’s financial planning and eligibility for available deductions under the old regime.

In India, the government imposes additional charges on taxes known as cess and surcharge. A cess is a tax on tax, levied for a specific purpose, such as education or health, and is applied uniformly to all taxpayers. For example, the education cess is used exclusively to fund educational initiatives. The proceeds from a cess are deposited into the Consolidated Fund of India and must be used only for the designated purpose.

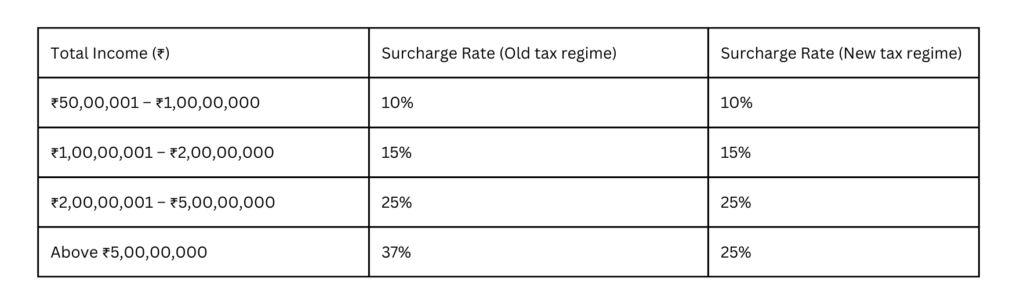

A surcharge, on the other hand, is an additional charge on the tax payable, typically imposed on income exceeding ₹50 lakh, with rates as follows:

Source: Incometax.gov.in

Note: The enhanced surcharge of 35% or 25% does not apply to income that is taxed under sections 111A, 112, 112A, or dividend income. For these incomes, the maximum surcharge rate is 15%

Unlike cess, the surcharge is not earmarked for any specific purpose and can be utilized by the government as needed.

Both cess and surcharge are collected by the central government and are not shared with state governments. They are deposited into the Consolidated Fund of India, with the surcharge being available for general use, while the cess is restricted to its specified purpose.

Alternative Minimum Tax ensures that non-corporate taxpayers, including HUFs, pay a minimum level of tax, even if they claim various deductions that might otherwise reduce their tax liability.

If an HUF’s adjusted total income exceeds ₹20 lakh and the tax calculated under normal provisions is less than 18.5% of this adjusted income, the HUF must pay the AMT rate of 18.5% (plus applicable surcharge and cess).

This provision prevents taxpayers from significantly reducing their tax obligations through deductions.

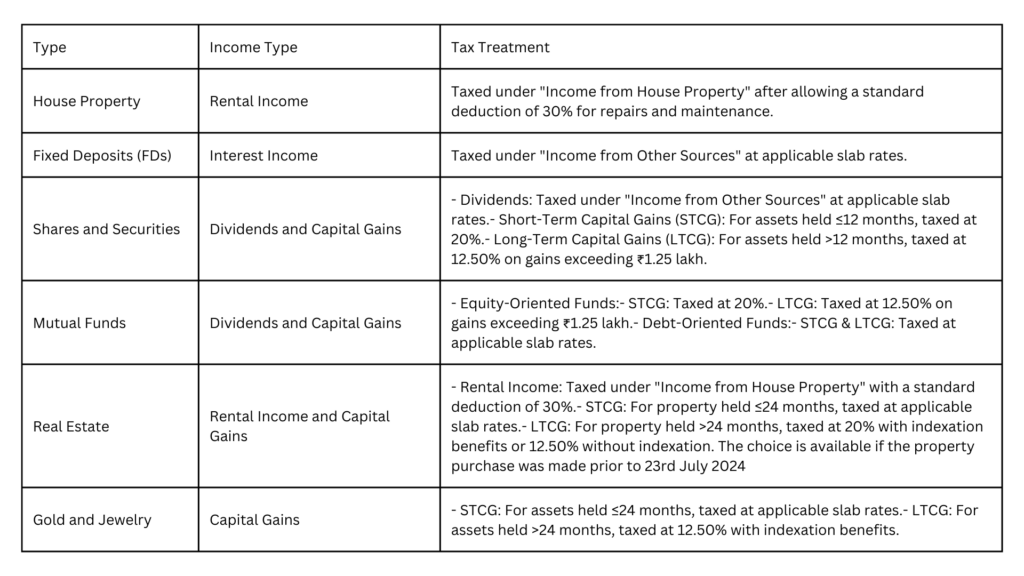

The taxation of assets and investments held by a HUF depends on the nature of the asset and the duration of its holding. Below is a table summarizing the tax implications for various assets:

Note: The HUF can claim deductions under sections like 80C, 80D, and 80G, subject to the conditions specified in the Income Tax Act.

A Hindu Undivided Family (HUF) is a distinct legal entity in India, comprising lineal descendants from a common ancestor. It enjoys separate tax benefits, including individual exemptions and deductions, which can lead to reducing the overall tax liabilities. However, managing an HUF requires careful consideration of legal and familial responsibilities.

For Financing and Taxation services in India for individuals as well as HUFs, get in touch with us. At GJM & Co, we offer assistance through different prospects including Business Formation, payroll management, bookkeeping and accounting services, etc. Schedule a call or email us at info@gjmco.com.